If youve wondered about e-filing here are the answers to frequently asked questions including why e-filing is a good idea which states let you e-file how much e-filing costs and how soon youll receive your refund. Get Your Free Trial.

How To Set Up Your Primary Username On Efiling And Manage Your Portfolios South African Revenue Service

Know the GSTR-9 and 9C Applicability for FY 2019-20.

. 1 online tax filing solution for self-employed. Must provide a copy of a current police firefighter EMT or healthcare worker ID to qualify. As per the Income-tax Act if any person makes a payment to the receiver then TDS is required to be deducted at a prescribed rate and then deposited with.

To sign up as a new e-referral user. A qualifying expected tax refund and e-filing are required. Get started with GSTHero for FREE today.

Click on the registration bar and select the non core amendment. Rental price 70 per night. GSTHero provides 100 online GST Return filing GSTR 2A2B Reconciliation Software e-Invoice Software and e-Way Bill Automation Software.

My office is pleased to provide this service to new homeowners in Palm Beach County. Login Register Pengguna Terdaftar. Read more Those having the aggregate annual turnover less than Rs.

The official department has given new due dates for filing GST annual returns Financial Year 2019-20 till 28th February 2021 from 31st December 2020. A Help video on how to file Form 10BD is available in the How To Videos section of the e-Filing Portal. Read the full communication pdf to know more.

Homestead Exemption can provide significant property tax savings and this interactive system will walk you. Individual HUF Firm LLP Company Trust and AOPBOI. Unduh Format Pengisian Form Aktivasi e-Filing Caleg DPD 2019 8.

DELHI- circular 24-05-2019 NEW. Register with e-filing and Continue. Self-Employed defined as a return with a Schedule CC-EZ tax form.

Aplikasi E-Filing juga dapat digunakan untuk melakukan pengunggahan maupun pengunduhan dokumen dalam rangka replik duplik dan kesimpulan pengelolaan penyampaian dan penyimpanan dokumen. ANDHRA PRADESH- User Registration Brochure 21-12-2021 NEW. Due Date is different according to audit or non-audit cases of such categories as defined in section 1391 Free Download Gen IT Software for e-Filing Returns.

To check your ITR e-filing status follow the steps mentioned below. Notice Regarding promotion for the Post TG-2 to the Post of JE Notice List on VIEW. How to change update Mobile number and email id in your Income Tax E filing account.

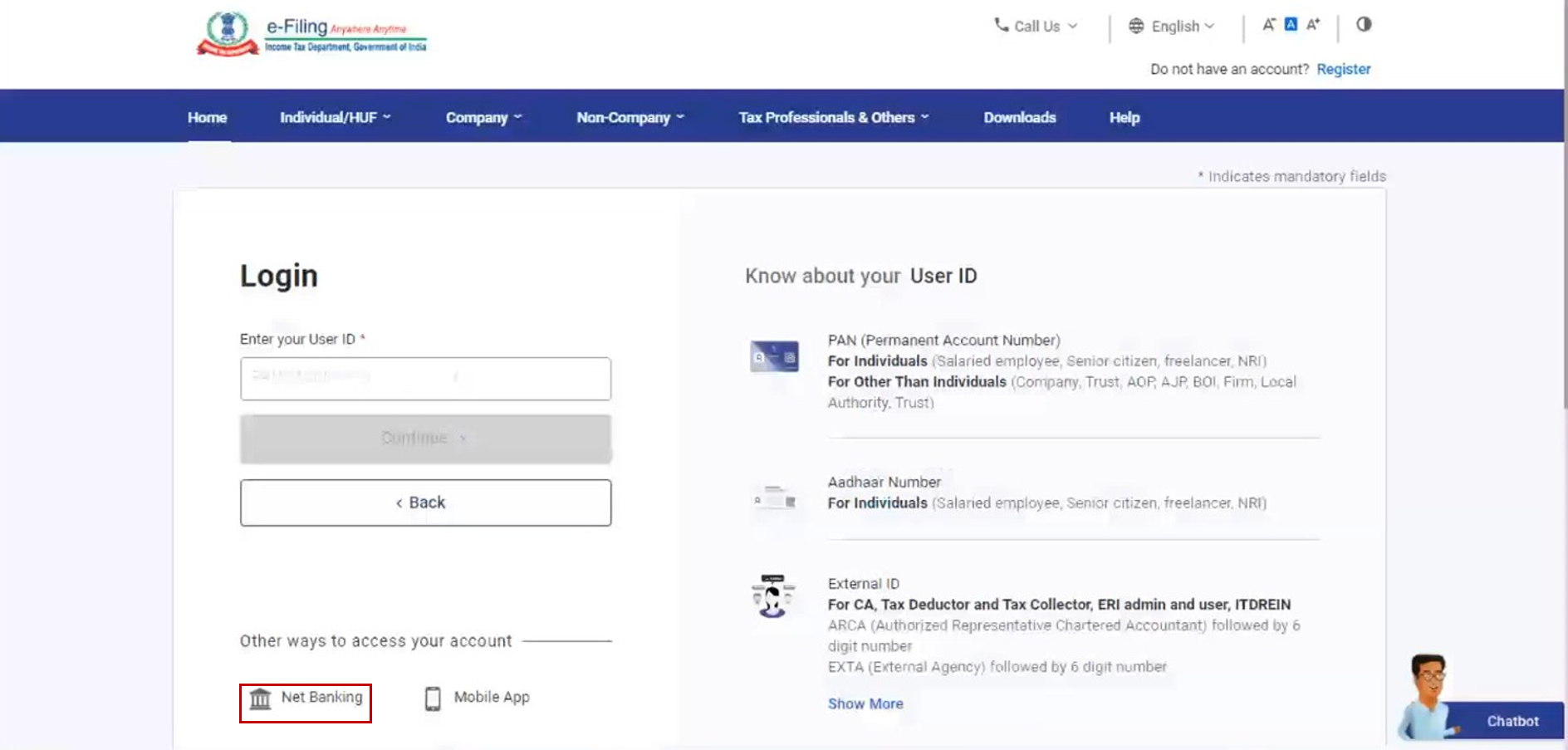

However under sections 216 2161 217 and 2183 of the Income Tax Act you have the option of filing a Canadian tax return and paying tax on certain types of Canadian-source income using an alternative tax method. E-filing of ITR 1 to 4 for AY 2022-23 is enabled ITR-1 ITR- 2 ITR-4 offline online both ITR-3-only. If PAN is previously registered in e-filing it will be redirected to the login page.

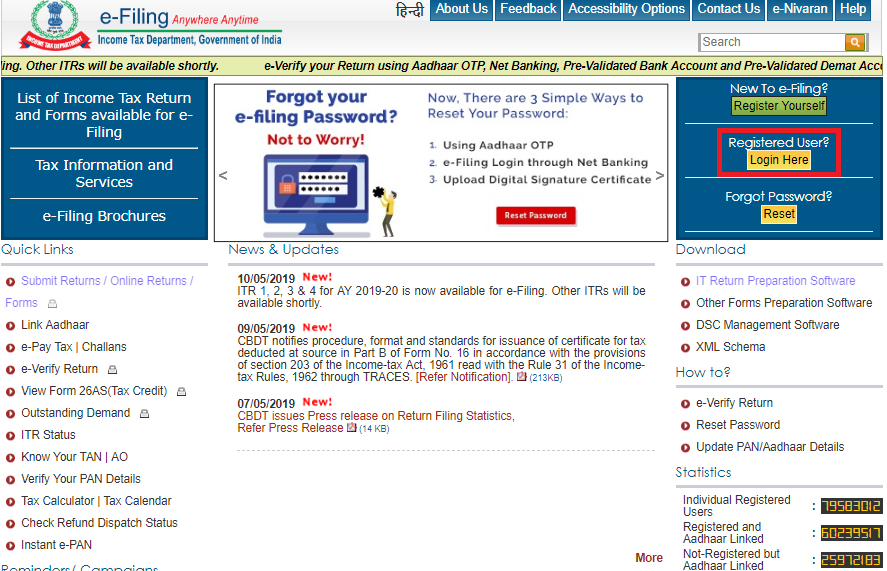

Dasar Hukum dalam pelaksanaan e-Court adalah Peraturan Mahkamah Agung RI Nomor 1 Tahun 2019. Untuk login ke dalam Aplikasi e-LHKPN disarankan menggunakan Web Browser Chrome minimal versi 57 atau Web Browser Firefox versi minimal 47. 2Click Login Here button.

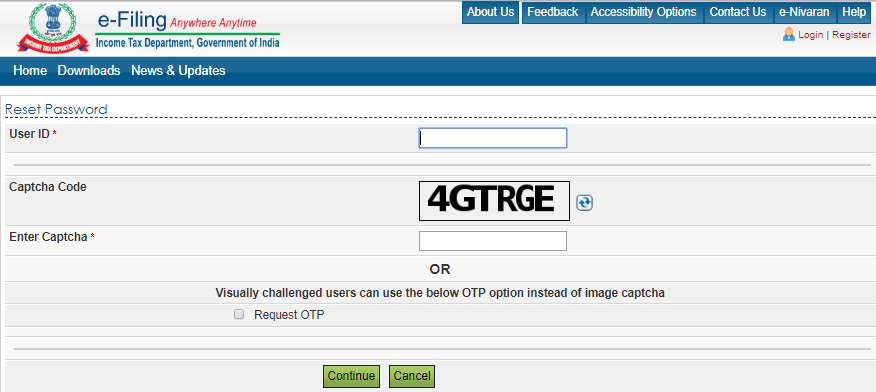

Forget that paper tax return. 1Go to Income Tax e-Filing portal httpswwwincometaxindiaefilinggovin. For a list of these guidelines visit the Florida Courts E-Filing Portal.

Based upon IRS Sole Proprietor data as of 2020 tax year 2019. Nine years after its introduction in 2010 e-AWB became the default contract of carriage for all air cargo shipments on enabled trade lanes on 1 January 2019. By doing so you may receive a refund for some or.

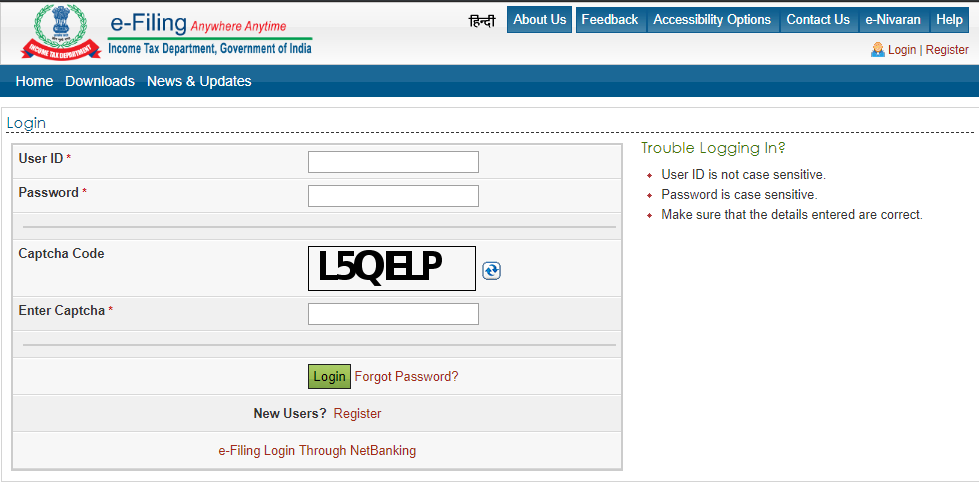

Find TDS return due dates and TCS return due dates with the time period and last date for filing for AY 2023-24 FY 2022-23. Log on to the new income tax e-filing portal by entering your PAN as user ID and your login password. Employer Login Login Help Customer Service.

Login with your user ID and password on Income tax portal Step 2. Login to file tax. No thanks and Continue without registering.

Welcome to Homestead Exemption online filing. How to e-filing income tax return online file ITR online ITR Filing Filing IT Return online E file ITR returns efiling itr e file income taxincome tax website. Electronic filing e-filing online tax preparation and online payment of taxes are getting more popular every year.

Untuk login ke dalam Aplikasi e-LHKPN disarankan menggunakan Web Browser Chrome minimal versi 57 atau Web Browser Firefox versi minimal 47. For Registered user Step 1. TDS stands for tax deduction at source while the TCS stands for tax collected at source.

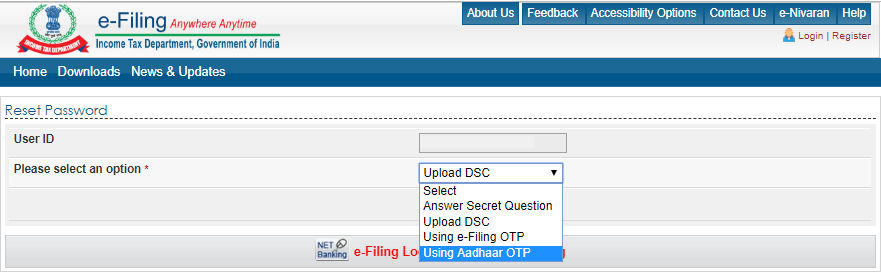

See terms and conditions for details. Enter User name password and Captcha code Click Login. For FAQs refer to News section.

Unduh Format Pengisian Form Aktivasi e-Filing Caleg DPD 2019 8. You must login at least once every 90 days to keep you user ID active. If your user ID is not working please contact Availity Client Services at 1-800-AVAILITY 1-800-282-4548.

Telangana- Circular - filing of cases in all government matters through efiling portal 10-03-2022 NEW. Pada modul e-Filing terdapat beberapa bagian yang dapat diisi oleh PNWL yaitu Data Pribadi Jabatan Keluarga Harta Penerimaan. The Florida Supreme Court has adopted the electronic format of PDFA Portable Document Format for Archiving as the official format for filing and storing electronic documents in the state.

This key industry milestone brings air cargo into a new era where digital processes are now the norm and paper is the exception. Filing Income Tax Return Due Dates for FY 2021-22 AY 2022-23 There is a different category of taxpayer viz. Madhya Pradesh- Regarding acting chief Justice 04-11-2019 NEW.

GSTHero Making GST Simple. Step 5. Select Register with e-filing and Continue to redirect to the Registration page.

After logging in Go to e-File option in the top bar and select Income Tax Returns and further select View Filed Returns from the drop-down. There are guidelines that should be followed in preparing documents that will be attached to portal submissions. Form 5BA to be filed under rule 8B6 for FY 2021-22 is available for filing on portal.

HR Block Maine License Number. LINK FOR DOWNLOADING ANSWER-KEY FILING OBJECTIONS OF AO AGAINST Adv No-1VSA2018 ASSISTANT ACCOUNTANT AGAINST Adv- 2VSA2018 TG-II AGAINST Adv -3VSA2018. After a long wait finally the Union Budget 2019 is here and one must remember this budget is here to stay.

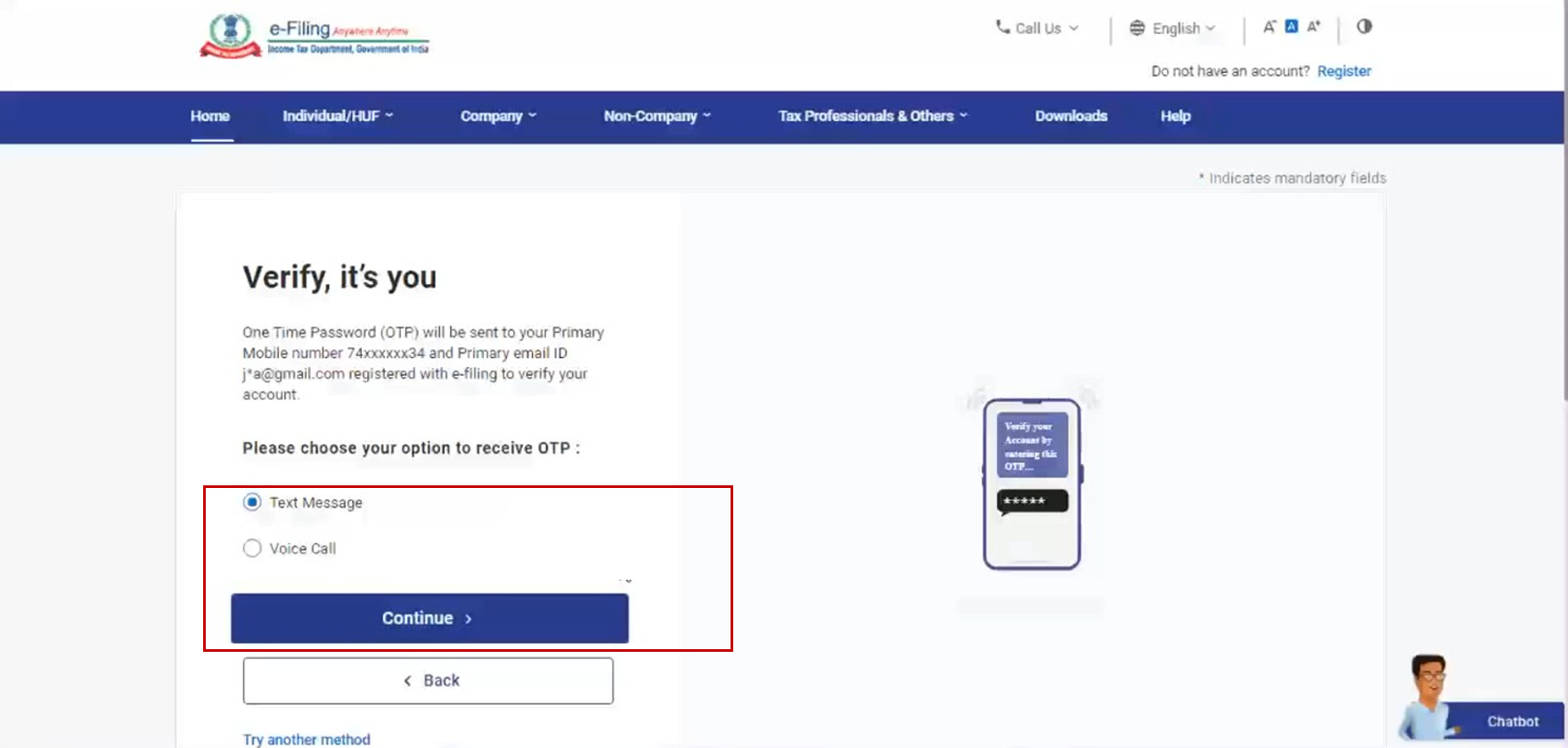

If PAN is not registered then the following options will be provided. User needs to Click on the Link provided in the E-mail and enter the OTP received in the mobile number for Successful activation of the new user in e-Filing portal. Telangana- e-Filing rules of high court for the state of telangana 10-03-2022 NEW.

To ensure continued access for current e-referral users. 3The user is requested to update a Mobile number and E-mail ID and click on the Continue. Online competitor data is extrapolated from press releases and SEC filings.

Valid for an original 2019 personal income tax return for our Tax Pro Go service only. Bagi Wajib LHKPN yang belum memiliki Akun e-Filing LHKPN. GPS coordinates of the accommodation Latitude 43825N BANDOL T2 of 36 m2 for 3 people max in a villa with garden and swimming pool to be shared with the owners 5 mins from the coastal path.

5 Crore the Last date can file GSTR-3B due in March April and May 2020 by the last week of June 2020. Unduh Tata Cara Pelaporan.

Step By Step Income Tax Login Registration Guide Paisabazaar Com

Income India Tax Efiling Portal Website Income Tax Tax Refund Income Tax Return

Online Company Registration In Jaipur Income Tax Return Income Tax Tax Return

Miraconnect Mira Connect Plus View Your Voucher Connect Plus Voucher Mira

31st March 2019 Last Date To File Itr Income Tax Return Tax Refund Income Tax

31st August 2019 Due Date To File Itr For Financial Year 2018 19 Assessment Year 2019 20 Spectrum A Completed Tax C Tax Software Income Tax Return Income

Paypal To My Login Account Paypal Paypal Business Accounting

Prepare Taxes For Your 2018 Tax Returns Tax Relief Center Tax Help Income Tax Preparation Preparing For Retirement

Itr Filing Is No Big Deal For Taxpayers Using E Lite Filing Services Income Tax Income Business Software

Step By Step Income Tax Login Registration Guide Paisabazaar Com

Step By Step Income Tax Login Registration Guide Paisabazaar Com

Income Tax Return Which Itr Should I File Income Tax Return Income Tax Tax Return

Sars Efiling Login Sign Into South Africa Revenue Service E Filing Account

Login User Manual Income Tax Department

How To Use Sars Efiling To File Income Tax Returns Taxtim Sa

E File Income Return Online Income Tax Return Tax Refund Income Tax

Step By Step Income Tax Login Registration Guide Paisabazaar Com

Login User Manual Income Tax Department